Bored Candy City Fee Comparison Calculator

Bored Candy City

0.15% fee

0.10% to LPs

0.05% buybacks

Uniswap/SushiSwap/PancakeSwap

0.30% fee

0.25% to LPs

0.05% protocol

MMFinance

0.17% fee

0.10% to LPs

0.05% buybacks

0.02% treasury

Fee Comparison Results

Total Trades

10

Total Volume

$10,000

Savings with BCC

$15.00

Bored Candy City would cost $15.00 in fees.

Other DEXs would cost $30.00 in fees.

Savings: 50.00% of trading costs

Important Note

This calculator shows theoretical savings based on fixed fee percentages. Actual trading costs depend on factors like liquidity depth, slippage, and network fees. Bored Candy City currently has very low trading volume, which may lead to poor liquidity and high slippage.

When you hear the name Bored Candy City is a decentralized exchange (DEX) and automated market maker (AMM) launched on the Cronos Chain that claims the lowest trading fees in the blockchain world. the promise of a low fee DEX immediately jumps out. The platform also bundles play‑to‑earn games, an NFT marketplace, and a native token called CANDY, positioning itself as a one‑stop Web3 gaming and DeFi hub. Below we break down how it works, what the numbers say, and whether the hype holds up.

What is Bored Candy City?

Bored Candy City (often abbreviated as BCC) operates as a DEX on the Cronos Chain, a layer‑1 blockchain that runs side‑by‑side with the Ethereum ecosystem. By leveraging the proven codebase of UniswapV2, the exchange offers standard AMM liquidity pools where token swaps are executed automatically based on a constant product formula.

The platform’s tagline - “all fees back to the community” - boils down to a fee‑splitting model: every trade incurs a 0.15% fee, of which 0.10% is paid to liquidity providers (LPs) and the remaining 0.05% is used for CANDY token buybacks. Unlike many competitors that keep a slice for the team, Bored Candy City claims to return 100% of collected fees to users.

Fee Structure and Distribution

Understanding the fee mechanics is crucial because it directly impacts trading costs and LP rewards. The table below summarizes the allocation:

| Component | Percentage of Trade Fee | Destination |

|---|---|---|

| Liquidity Provider Reward | 0.10% | Distributed to LPs in proportion to their share |

| Buyback & Protocol Owned Liquidity | 0.05% | Used to buy CANDY tokens, which are then locked as POOL |

For comparison, most major DEXs charge a flat 0.30% fee, split 0.25% to LPs and 0.05% to the protocol. Bored Candy City’s 0.15% fee is exactly half of that, making it the cheapest DEX on any public blockchain - at least on paper.

Tokenomics of the CANDY Token

The native utility token, CANDY, powers both the DeFi and gaming sides of the ecosystem. Key metrics (as of August2025) are:

- Maximum supply: 250million CANDY

- Current circulating supply: not fully disclosed, but market data shows a very low daily volume

- Price: roughly $0.0015 per token

- Fully‑diluted market cap: about $383k

The 0.05% buyback portion of each trade uses native ETH‑compatible assets to purchase CANDY on the open market, then locks the bought‑back tokens in a protocol‑owned liquidity (POL) vault. This creates a deflationary pressure - fewer tokens in circulation - while simultaneously ensuring that the DEX always has liquidity for traders.

Gaming, NFTs, and the Diamond Structure

Beyond swapping, Bored Candy City tries to capture gamers by offering a mobile app that mimics popular match‑3 puzzles. Players earn CANDY by completing levels, climbing leaderboards, and entering daily competitions. All in‑game assets are tokenized as NFTs and sold or traded on an integrated NFT Marketplace built with a “Diamond Structure” smart‑contract architecture, which allows modular upgrades without breaking existing token standards.

The expectation is that strong gaming engagement will funnel new users into the DEX, increasing swap volume and therefore more buybacks for CANDY. In theory, the loop works, but execution matters - and that is where the platform starts to show cracks.

Competitive Landscape: Bored Candy City vs. MMFinance

MMFinance is the current market leader on Cronos for low‑fee AMM services. It introduced the concept of Protocol Owned Liquidity in 2023 and still charges a 0.17% fee. Below is a side‑by‑side look:

| Feature | Bored Candy City | MMFinance |

|---|---|---|

| Trading fee | 0.15% | 0.17% |

| LP reward | 0.10% | 0.10% |

| Buyback & POL | 0.05% | 0.05% |

| Team / Treasury cut | 0% | 0.02% |

| Gaming integration | Yes (P2E + NFT) | No |

| 24‑hour volume (CANDY) | $54k (avg) | $1.2M (avg) |

While Bored Candy City beats MMFinance on raw fee percentage and the “all‑revenue‑to‑users” claim, it trails far behind in real market activity. MMFinance’s higher volume means more genuine liquidity and a healthier token economy.

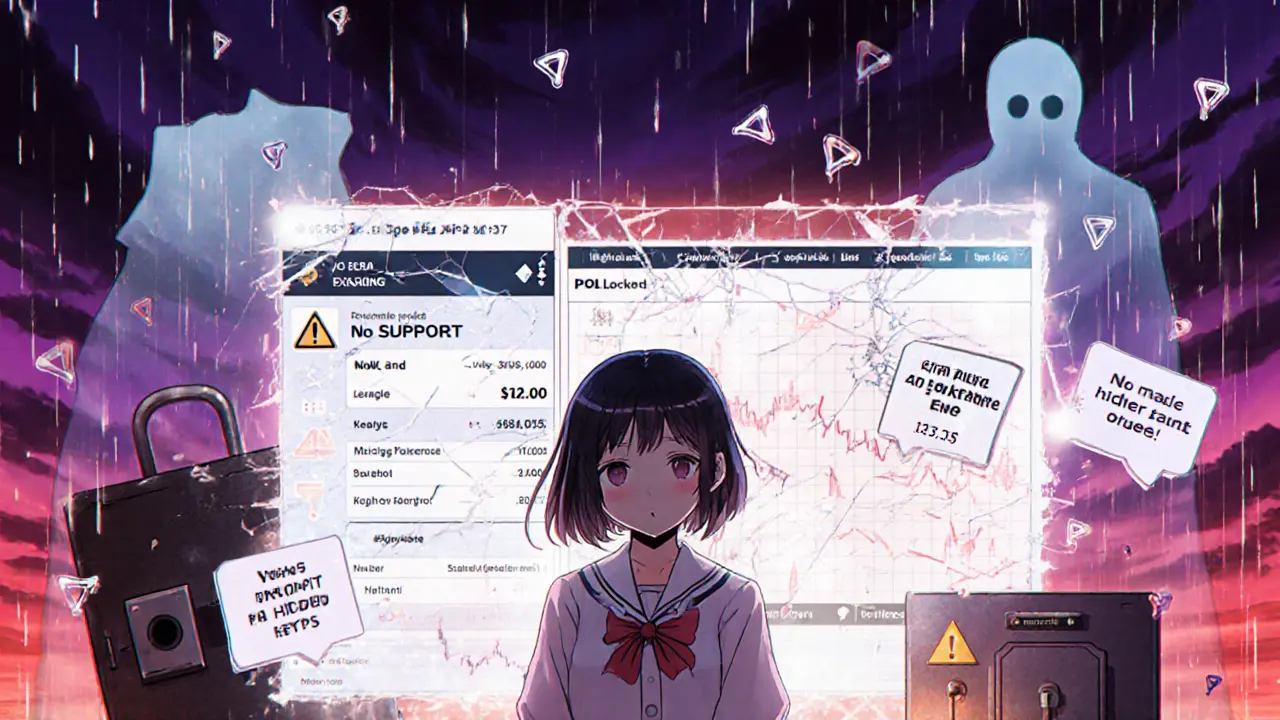

User Experience & Red Flags

From a UI standpoint the platform is clean. The mobile app mirrors classic match‑3 games, and the web DEX interface feels familiar to anyone who has used Uniswap. However, user feedback paints a worrying picture:

- Multiple iOS App Store reviews label the app a “scam,” citing paid in‑game purchases that never arrived.

- Support channels are virtually silent; no live chat, email response times exceed weeks, and the official Discord often goes unanswered.

- Trading data shows the CANDY token “not traded anywhere” on major aggregators for several days, indicating a thin order book and potential price manipulation.

- CoinGecko reports 24‑hour volume as low as $26, suggesting almost no genuine market interest.

These issues suggest that while the code may be functional, the business side - especially the gaming payoff and customer service - is severely under‑delivered.

Security, Decentralization, and Protocol Owned Liquidity

From a smart‑contract perspective, Bored Candy City reuses battle‑tested UniswapV2 logic, which reduces the risk of novel bugs. The addition of a POL vault - a smart contract that holds bought‑back CANDY - aligns with best practices for sustainable liquidity. However, true decentralization also requires transparent governance and a robust audit trail, both of which are lacking. No public audit reports have been released, and the governance token (if any) is not mentioned on the website.

Without clear on‑chain governance, the community cannot verify that the protocol truly returns all fees or that the POL vault is managed in a trust‑less manner. This opacity increases the risk of hidden admin keys that could redirect funds.

Should You Use Bored Candy City? - Pros, Cons, and Checklist

If you’re deciding whether to try the platform, consider the following quick checklist:

- Pros

- Ultra‑low 0.15% trading fee - the cheapest DEX on any chain.

- Full fee redistribution: LPs earn 0.10% and token buybacks create deflationary pressure.

- Integrated gaming and NFT marketplace for users who enjoy play‑to‑earn.

- Built on audited UniswapV2 code, reducing smart‑contract risk.

- Cons

- Extremely low liquidity and trading volume - you may experience high slippage.

- Scant user support; numerous reports of unpaid in‑game purchases.

- Lack of public audits and transparent governance.

- Token price is volatile and market‑cap tiny, making large trades risky.

For experienced DeFi traders who prioritize fee savings and are comfortable navigating low‑volume markets, Bored Candy City could be a niche tool. For casual users or gamers looking for reliable payouts, the platform’s support gaps and thin liquidity are red flags.

Bottom Line

Bored Candy City offers an intriguing blend of low‑fee swapping, token buybacks, and P2E gaming. Its fee model genuinely undercuts most competitors, and the POL mechanism is conceptually sound. However, the reality on the ground - negligible trading volume, absent customer service, and a token that barely moves - undermines the promise of a vibrant community‑owned ecosystem. Until the team addresses liquidity, audits, and support, treating the platform as an experimental side‑project rather than a primary exchange is the safest approach.

Frequently Asked Questions

What blockchain does Bored Candy City run on?

The exchange is built on the Cronos Chain, a side‑chain that offers low transaction costs and compatibility with Ethereum tools.

How low are the trading fees compared to other DEXs?

Bored Candy City charges a flat 0.15% fee. By contrast, Uniswap, SushiSwap and PancakeSwap typically charge 0.30%.

What happens to the 0.05% fee that isn’t paid to LPs?

That portion is used for CANDY token buybacks, which are then locked in a Protocol Owned Liquidity vault to support price stability and create a deflationary effect.

Is the platform audited?

Public audit reports have not been published. The core swapping logic reuses UniswapV2 code, but the custom NFT marketplace and POL contracts lack third‑party verification.

Can I earn CANDY by playing the mobile game?

Yes, the app rewards players with CANDY for completing puzzles and entering competitions, but many users report that earned tokens are delayed or never delivered.

Jack Stiles

October 8, 2025 AT 08:30Just a heads-up that Bored Candy City’s low fees look sweet, but the thin liquidity could bite you when you try to move bigger chunks.

Keep an eye on slippage – it can turn a “cheap” trade into a pricey surprise.

Debra Sears

October 14, 2025 AT 03:23It’s a good idea to test with a tiny amount first.

Brian Lisk

October 21, 2025 AT 02:03Bored Candy City markets itself as a low‑fee haven for casual traders and gamers alike, and on paper the 0.15 % taker fee certainly undercuts the usual 0.30 % you see on Uniswap or PancakeSwap.

However, the fee structure also allocates only a modest slice to liquidity providers, which can lead to shallow order books.

When you place a trade that exceeds the limited depth, the price you receive may drift significantly from the mid‑price, effectively increasing your cost beyond the advertised fee.

Moreover, the platform’s current trading volume is relatively low, a fact that is reflected in the sparse activity on its price charts.

Low volume often translates to higher slippage, especially for pairs that don’t have major backing tokens.

Slippage can be a silent killer because it isn’t captured in the fee calculator; you end up paying more in execution than the fee line suggests.

Another point worth mentioning is the network gas fees that accompany each transaction, which on congested chains can dwarf the 0.15 % fee for small trades.

If you’re swapping a few dollars worth of tokens, the gas can easily be a dollar or more, turning a “cheap” trade into a pricey one.

The BCC token itself has a gamified tokenomics model that rewards certain in‑app activities, which might appeal to crypto‑gamers but adds another layer of complexity for pure traders.

Those rewards can be attractive, yet they also tie up liquidity in promotional pools that may not be readily available for normal swaps.

From a risk perspective, the platform’s smart contracts are relatively new, and while they have undergone audits, the DeFi space is notorious for hidden vulnerabilities.

A single exploit could drain funds or freeze liquidity, leaving users with little recourse.

It’s also prudent to consider the regulatory environment; newer exchanges sometimes operate in gray zones that could affect token listings or user access.

In summary, the fee savings are real on the surface, but they must be weighed against potential slippage, gas costs, liquidity risk, and smart‑contract risk.

If you value transparency and deep liquidity above minimal fees, you might stay on larger DEXs, but if you’re comfortable with higher risk for lower fees, BCC could be worth a small trial.

Ultimately, the decision hinges on how much you plan to trade and how tolerant you are of the inherent volatility of a nascent platform.

Dawn van der Helm

October 27, 2025 AT 09:50Loving the vibe of Bored Candy City – the low fees feel like a fresh breeze! 🌬️

Just remember the liquidity might be thin, so start small and watch the slippage.

Overall, it’s a fun playground for crypto‑gaming fans.

Monafo Janssen

November 2, 2025 AT 04:43From a cultural standpoint, Bored Candy City mixes crypto with gaming, which can attract new users who might otherwise avoid finance.

The fee advantage is appealing, but the platform’s young age means you should stay cautious.

Try a modest amount and see how the community feels.

Michael Phillips

November 7, 2025 AT 09:43One might view the trade‑off between fee minimization and liquidity depth as a broader metaphor for risk versus reward in life.

In seeking lower costs, we sometimes expose ourselves to hidden volatility, much like accepting a bargain that hides unseen flaws.

Thus, a measured approach, acknowledging both the apparent savings and the latent risks, seems prudent.

Jason Duke

November 12, 2025 AT 00:50Enough of this lofty talk-if you’re not willing to take a little risk, you’ll never see real gains!!!

Low fees are a clear advantage, and the community should jump on it now.

Franceska Willis

November 16, 2025 AT 02:03Yo, chill out! The hype can be fun, but those thin order books can zap your profits faster than a meme coin rocket.

Don’t get blinded by the shiny fee banner-watch the charts.

Mark Bosky

November 19, 2025 AT 13:23While informal enthusiasm is understandable, a prudent investor must conduct due diligence.

Specifically, assess contract audits, liquidity depth, and potential regulatory implications before allocating capital.

Richard Bocchinfuso

November 22, 2025 AT 10:50Feez look good but the real game is who’s got the juice behind the trades.

Jasmine Kate

November 24, 2025 AT 18:23OMG, this whole Bored Candy City thing is a total circus! 🎪

Everyone’s shouting about low fees while the hidden fees are lurking in the shadows, ready to bite you when you least expect it.

Don’t be fooled by the glitter-this platform could turn your wallet into a joke.

Mark Fewster

November 26, 2025 AT 12:03Indeed, the excitement can mask underlying risks; thorough examination is essential.

Ritu Srivastava

November 27, 2025 AT 15:50The moral of the story is clear: platforms that promise low fees but hide shallow liquidity are simply exploiting naïve traders.

We must demand transparency and accountability from every exchange, no matter how shiny its branding appears.

Caleb Shepherd

November 28, 2025 AT 14:03Actually, the underlying smart‑contract code of Bored Candy City has been audited by reputable firms, and the reports are publicly available.

So while caution is always wise, the platform isn’t a black box waiting to explode.

Matthew Laird

November 29, 2025 AT 09:30Audits are just pieces of paper; they don’t stop a determined attacker or a corrupt insider.

Don’t be fooled-keep your funds in proven, high‑volume DEXs where the community watches every move.