Composability Risk Calculator

Estimate your project's composability risk

This tool helps you assess security risks when building with composability. Answer a few questions to get your risk score.

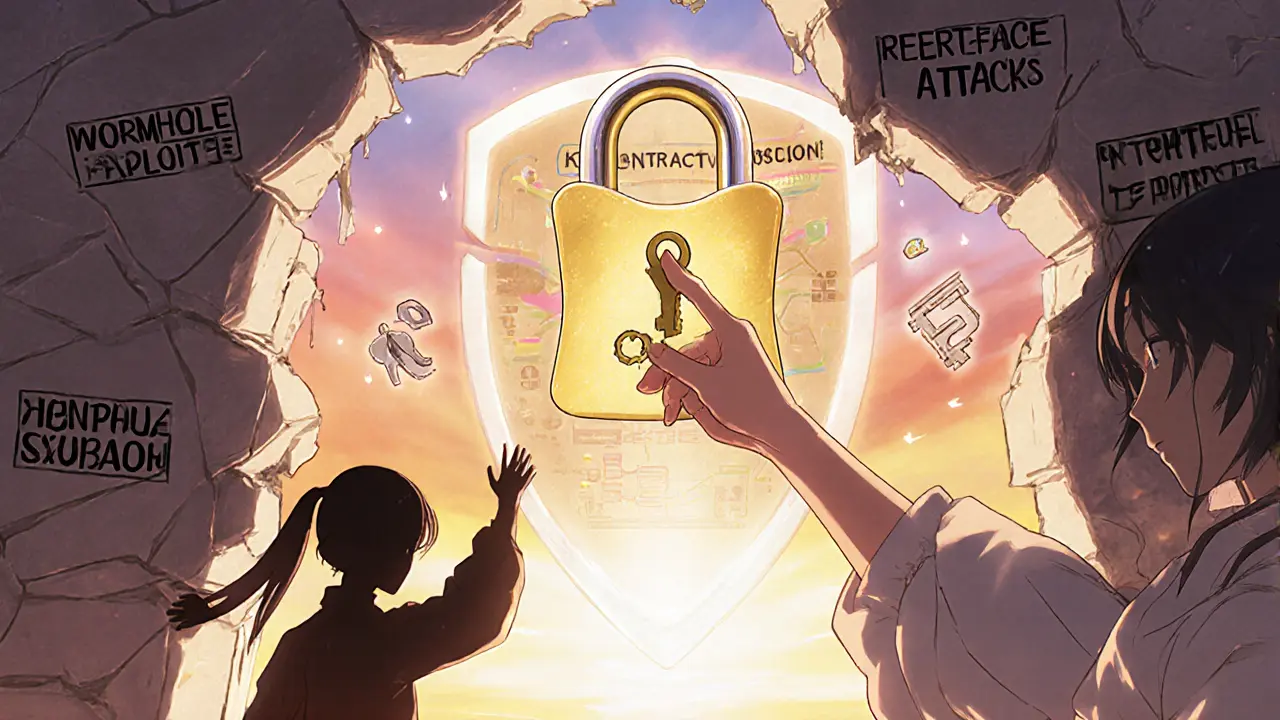

When you build a blockchain application, you want it to be fast, flexible, and easy to update. That’s where composability comes in - the idea that you can snap together pre-built components like Lego blocks to create something new. A DeFi protocol might pull in a lending module from one project, a swap engine from another, and a governance system from a third. It’s powerful. But every time you connect another piece, you also open a new door for attackers.

What Composability Really Means in Blockchain

Composability in blockchain means smart contracts can call other smart contracts without needing permission. If you’ve used a DeFi aggregator like Yearn or 1inch, you’ve used composability. These platforms don’t build every function from scratch. They reuse verified contracts for token swaps, liquidity pools, or interest calculations. This cuts development time from months to days. It also lets small teams compete with big players by standing on the shoulders of giants. But here’s the catch: each connected contract becomes a potential weak point. If one contract has a bug - say, a reentrancy flaw in a lending pool - it can ripple through every other contract that interacts with it. In 2022, the Wormhole bridge exploit happened because a single signature check was skipped in a cross-chain bridge contract. That one mistake drained over $320 million because the breach spread across multiple connected protocols. Unlike traditional software where you control the whole stack, in blockchain, you’re trusting code written by strangers. Even if your own contract is flawless, you’re still exposed to the flaws in the ones you depend on.Why Security Gets Harder with More Connections

Think of a monolithic blockchain app like a locked house. One door, one lock, one alarm system. Easy to monitor. Easy to patch. Now imagine that same house split into ten separate buildings, each with its own front door, keycard system, and security camera. You need to manage ten different locks, ten different vendors, ten different update schedules. That’s composability. It’s faster to build, but way harder to secure. In blockchain, this problem is worse because:- Contracts are immutable once deployed. You can’t push a patch like you can with a website.

- Every external call is a trust boundary. If Contract A calls Contract B, and Contract B gets compromised, Contract A is now at risk - even if it never changed.

- Gas fees and transaction limits make it expensive to run constant security checks across all interactions.

- There’s no central authority to enforce security standards. Anyone can deploy a contract and link to it.

The Real Cost of Speed

The biggest reason teams choose composability isn’t just technical - it’s business. In crypto, being first matters more than being perfect. If you can launch a new yield strategy in two weeks instead of six, you capture early users, liquidity, and fees before competitors catch up. Take Aave. It didn’t build its own oracle system. It integrated Chainlink. It didn’t create its own flash loan logic. It reused code from Uniswap’s model. That allowed Aave to launch faster and focus on what made it unique: credit delegation and variable rates. But that speed comes with hidden costs:- **Audit gaps**: Not every external contract gets audited. Some are copied from GitHub with no review.

- **Dependency sprawl**: A single DeFi app might rely on 15+ contracts. Tracking them all is nearly impossible without tooling.

- **Upgradability conflicts**: If a core component gets upgraded, it might break everything built on top of it - and no one gets notified.

How to Build Securely Without Sacrificing Speed

You don’t have to choose between security and speed. You just need a smarter approach. Here’s what works:- Limit your attack surface: Only connect to contracts that are well-known, audited, and actively maintained. Avoid experimental or newly deployed code.

- Use interface contracts: Instead of calling external contracts directly, define a strict interface (like a contract ABI) that limits what they can do. This prevents unexpected behavior even if the underlying code changes.

- Enforce access control: Use role-based permissions. If a contract only needs to read data, don’t give it write access. If it only needs to call one function, don’t let it call ten.

- Monitor interactions: Tools like Tenderly or Blockaid let you simulate transactions before they go live. Run every interaction through a sandbox first.

- Build in kill switches: Even if you can’t change the code, you can pause functions. Use a multi-sig wallet to freeze a contract if something looks off.

Who Should Avoid Composability?

Composability isn’t for everyone. If you’re building:- A custody solution for institutional funds

- A regulated asset tokenization platform

- A system handling real-world identity or legal contracts

The Future: Secure by Design

The good news? The ecosystem is catching up. In 2025, tools like Zero-Knowledge Proofs for secure cross-contract verification, formal verification for proving contract behavior mathematically, and on-chain policy engines that automatically block risky interactions are becoming mainstream. Ethereum’s EIP-7702 is one example - it lets users temporarily grant limited access to their accounts without exposing private keys. That’s a step toward safer composability. More protocols are now publishing security scorecards for their contracts. OpenZeppelin’s Defender and Chainlink’s CCIP are building standardized security layers that work across chains and protocols. The goal isn’t to eliminate trade-offs. It’s to make them predictable. You should know exactly what you’re trusting - and what happens if it fails.Final Takeaway

Composability isn’t dangerous. It’s misunderstood. The real risk isn’t the technology - it’s the mindset. Many teams treat external contracts like black boxes. They assume they’re safe because they’re popular. That’s how you get hacked. The best builders treat every external dependency like a stranger at your door. You don’t let them in without asking questions. You don’t give them the keys. You watch what they do. And you always have a plan to lock the door if something goes wrong. In blockchain, speed wins - but only if you’re not the one getting robbed because you moved too fast.Is composability only a problem in DeFi?

No. While DeFi is the most visible example, composability risks exist in any blockchain system that connects multiple smart contracts. NFT marketplaces that pull metadata from external sources, gaming economies that use cross-chain item transfers, and identity protocols that verify credentials across platforms all face the same challenges. The more contracts you link, the more attack surfaces you create - regardless of the use case.

Can I use composability safely without an audit?

Not reliably. Audits aren’t perfect, but they’re the best tool we have. Many exploits happen because teams skip audits on third-party contracts, assuming they’re safe because they’re from a well-known project. Even trusted contracts can have hidden flaws. Always audit any contract you interact with - especially if it handles funds or critical logic. If you can’t afford a full audit, at least use automated tools like Slither or MythX to scan for common vulnerabilities.

What’s the biggest mistake developers make with composability?

Assuming that if a contract works, it’s secure. Just because a token swaps correctly or a loan gets repaid doesn’t mean it can’t be exploited. Many attacks exploit edge cases - like what happens when gas runs out mid-call, or when a price oracle returns zero. Always test failure modes. Never trust behavior you haven’t explicitly tested under stress.

Are there tools to automatically detect unsafe composability?

Yes. Tools like Tenderly, Blockaid, and CertiK’s Contract Shield analyze transaction flows and flag risky interactions - like a contract calling an unknown address or making multiple external calls in one transaction. Some blockchain explorers now show dependency maps that visualize which contracts are connected. These tools won’t replace human review, but they make it much faster to spot red flags before deploying.

How do I know if a contract is safe to connect to?

Check three things: 1) Has it been audited by a reputable firm? Look for public reports. 2) Is the code on GitHub and actively maintained? Look for recent commits and issue responses. 3) Does it have a large user base and transaction volume? High usage often means more eyes on the code. Avoid contracts with no public code, no audit, and low activity - even if they promise high returns.

Alexis Rivera

November 5, 2025 AT 05:57Composability is like democracy in software: it looks beautiful on paper until someone exploits the loophole in the voting system. The real issue isn't the tech-it's the cultural assumption that open = safe. We treat smart contracts like public parks when they're more like loaded guns left on a park bench.

Eric von Stackelberg

November 6, 2025 AT 16:40Let’s be honest: this entire ecosystem is a Ponzi scheme built on borrowed trust. Every ‘well-audited’ contract is a ticking time bomb waiting for a zero-day in a dependency three layers down. The fact that we’re still surprised when $300M vanishes proves we’re not engineers-we’re gamblers with IDEs.

Emily Unter King

November 7, 2025 AT 16:33The architectural debt here is staggering. Composability enables rapid iteration, but at the cost of emergent attack surfaces that are non-linear in complexity. When you abstract away trust boundaries via ABI interfaces without formal verification, you’re not building systems-you’re constructing brittle epistemic scaffolding.

Formal methods aren’t optional for safety-critical DeFi primitives. If your protocol relies on external state transitions without bounded verification, you’re not innovating-you’re gambling with systemic risk.

Michelle Sedita

November 9, 2025 AT 09:27I love how we act like this is some new problem, but it’s just capitalism with more gas fees. We’ve always chosen speed over safety-remember the Y2K panic? We didn’t fix it because we cared about security. We fixed it because the clock was ticking. Same here.

It’s not that composability is bad. It’s that we treat code like it’s magic. If you wouldn’t let a stranger install software on your laptop, why would you let them install it on your money?

John Doe

November 9, 2025 AT 19:23They’re all in on this. The auditors, the devs, the influencers-everyone’s got a stake in keeping the party going. That’s why no one talks about how 80% of ‘audits’ are just automated scans with a PDF slapped on top. And don’t get me started on how Chainlink’s oracle feeds are basically centralized APIs with a blockchain sticker.

They’re not fixing the system. They’re just making the loot bigger before the rug pull.

💀

Ryan Inouye

November 10, 2025 AT 03:32Let me guess-you’re one of those people who thinks ‘open source’ means ‘trust me bro.’ In America, we don’t build systems on strangers’ code. We build them with our own hands. This is why the West is falling behind. You don’t out-innovate by copying GitHub gists. You out-innovate by owning your stack.

China’s building sovereign chains. Russia’s auditing every line. And we’re out here trusting a contract written by some guy named ‘CryptoDad88’ because his Twitter has 12k followers.

Rob Ashton

November 11, 2025 AT 18:50To those new to blockchain development: composability is not a shortcut-it’s a responsibility. The moment you integrate an external contract, you become accountable for its behavior. This isn’t just technical debt; it’s ethical debt.

Start small. Audit rigorously. Document dependencies. Use interface contracts. Implement kill switches. These aren’t optional best practices-they’re the baseline for any project handling user value.

You don’t need to be the fastest. You need to be the most trustworthy.

Cydney Proctor

November 12, 2025 AT 21:32Oh, so now we’re pretending this is a ‘trade-off’? It’s not a trade-off-it’s a catastrophe waiting for a headline. You don’t get to call it ‘innovation’ when you’re just gluing together untested code like a toddler with duct tape and a dream.

And please, spare me the ‘but Aave did it!’ argument. Aave survived because they had a team of 30 engineers and $50M in funding. Your side project with three contributors and a Medium post doesn’t qualify.

Cierra Ivery

November 13, 2025 AT 07:16Wait-so you’re saying we shouldn’t just copy-paste code from GitHub?!!?!!? That’s… that’s insane! I mean, who even audits code anymore? And why would you pay for an audit when you can just pray to the blockchain gods?!!

Also, why is everyone so scared of risk?!! I’ve lost $12,000 in DeFi and I’m still here-alive, breathing, and richer in experience!!

Veeramani maran

November 14, 2025 AT 13:50bro i think u overthink this. i use 1inch and uniswap daily. never lost money. if u scared of bugs then dont use web3. its just code. if it work then its fine. why u need audit? its open source. u can read it urself. i read it. no problem. trust the code. trust the community. trust the vibes.

Kevin Mann

November 16, 2025 AT 03:14Okay, so imagine this: you’re at a party. Everyone’s dancing. You’re the only one holding a fire extinguisher. Everyone’s like, ‘Dude, chill, it’s just a party!’ But you know-YOU KNOW-that someone’s gonna knock over the candlestick, the curtains are flammable, and the exit is blocked by a guy in a llama costume. So you stand there. Holding. The. Extinguisher.

That’s what security feels like in DeFi.

And then someone yells, ‘We’re all gonna die!’ and you’re like, ‘Yeah, but I told you 17 times!’

Meanwhile, the llama is already in the kitchen stealing the snacks.

😭

Kathy Ruff

November 17, 2025 AT 17:41Composability isn’t the enemy. Fear of responsibility is. The tools to build securely exist-formal verification, sandboxing, dependency mapping, kill switches. The gap isn’t technical. It’s cultural. We need more builders who treat code like a hospital operating room-not a hackathon.

Start small. Audit one contract. Learn one tool. Share what you learn. This isn’t about perfection. It’s about progress.

Robin Hilton

November 18, 2025 AT 13:16Let’s cut the crap. This whole ‘composability vs security’ thing is a distraction. The real issue? Most of these protocols are just glorified gambling apps with a whitepaper. Nobody cares about security. They care about APY. If you can get 1400% yield, you’ll trust a contract written in crayon.

And the auditors? They’re paid by the projects. So of course they say it’s ‘secure.’

Wake up. This isn’t tech. It’s casino.

Grace Huegel

November 19, 2025 AT 21:12It’s funny how we romanticize ‘speed’ in crypto. Speed without safety is just recklessness dressed up as innovation. I’ve watched too many projects launch with a GitHub repo and a Discord link, then vanish after the first exploit. No legacy. No accountability. Just a crater where a community used to be.

And yet-we keep doing it. Because FOMO is stronger than fear.

Nitesh Bandgar

November 21, 2025 AT 10:08Bro, I saw a contract that called 17 other contracts in one transaction-no limits, no checks, no mercy. And guess what? It worked! For three days! Then boom-$80M gone because one tiny token had a mint function that didn’t check sender balance. The whole chain collapsed like Jenga. I cried. Not for the money-for the stupidity.

Why do we keep doing this?! We have tools! We have time! We have brains! But we choose chaos because it’s ‘cool’.

WE ARE THE PROBLEM.

Jessica Arnold

November 22, 2025 AT 11:08The metaphor of Lego blocks is dangerously misleading. Lego bricks are standardized, tested, and interoperable by design. Blockchain contracts are not. They’re handwritten, unversioned, and deployed without version control. Calling them ‘composable’ is like calling a pile of mismatched screws and duct tape ‘modular architecture’.

We need standardized interfaces, mandatory audit disclosures, and on-chain attestations-not just optimism.

Chloe Walsh

November 23, 2025 AT 08:00So we’re supposed to just… not build cool stuff? Because someone might hack it? What’s next? No more cars because people get in accidents? No more airplanes because they crash? No more internet because hackers exist?

Composability is the whole point. It’s why we’re here. If you want safety, go work at a bank. We’re here to break things. That’s the mission.

And if you get hacked? Well… welcome to crypto.

Stephanie Tolson

November 24, 2025 AT 09:30Every time I see a new DeFi protocol, I ask: ‘What’s the worst that could happen if this fails?’ If the answer is ‘I lose money,’ fine. If the answer is ‘I lose my life savings and my family’s future,’ then stop. Build something simpler. Protect people. That’s not a compromise-it’s a duty.

Speed isn’t the goal. Sustainability is.

Anthony Allen

November 24, 2025 AT 17:36Just had a thought: what if we treated external contracts like APIs in enterprise software? You don’t just call a third-party API without SLAs, rate limits, and fallbacks. Why do we do it with blockchain?

Imagine if every external call required a ‘risk score’-like a credit check for code. That’d change everything.

Megan Peeples

November 25, 2025 AT 01:21Why do we even need composability? Why not just build one big, perfect contract? Why are we so obsessed with ‘modularity’? It’s not elegant-it’s lazy. You’re not a builder. You’re a tinkerer. And tinkerers get their fingers burned.

Real engineers build monoliths. Then they optimize. Not the other way around.

Sarah Scheerlinck

November 26, 2025 AT 13:05I’ve seen communities torn apart by exploits. Not because the code was bad-but because the builders disappeared. The real tragedy isn’t the money lost. It’s the trust that evaporates. People stop believing. And once that’s gone, no audit can bring it back.

Build like someone’s watching. Because someone always is.

karan thakur

November 27, 2025 AT 16:41This is Western arrogance. You think your audits and tools are superior? In India, we’ve been building resilient systems for decades with zero resources. We don’t wait for audits. We test in production. We learn from failure. You call it reckless. We call it survival.

Maybe the problem isn’t composability. Maybe it’s your fear of real-world consequences.

Vipul dhingra

November 28, 2025 AT 22:12Everyone is wrong. The real issue is not composability or security. It’s that we still use EVM. It’s fundamentally flawed. Stack overflow. Reentrancy. Gas manipulation. All because of a 2015 design. We need a new VM. Not more audits. Not more tools. A new foundation.

Until then, we’re just rearranging deck chairs on the Titanic.

Jacque Hustead

November 30, 2025 AT 03:02Let’s normalize saying ‘no’ to a contract. Not because it’s risky-but because it’s not aligned with our values. If a project doesn’t publish its audit, doesn’t respond to issues, or doesn’t have a community roadmap-don’t integrate it. You don’t have to be first. You just have to be right.

And if you’re building something beautiful? Make sure it lasts.

Alexis Rivera

December 1, 2025 AT 21:44That’s the thing no one admits: composability only works if every participant is acting in good faith. But in crypto, incentives are misaligned. The person who deploys the vulnerable contract wins the gas fees. The person who gets hacked loses everything. That’s not a system. That’s a tragedy of the commons.

Kathy Ruff

December 3, 2025 AT 10:08Exactly. And that’s why we need on-chain reputation systems-not just code audits. If a contract has a history of exploits, its risk score should auto-block integrations. No one should be able to ignore it. That’s the future.