PancakeSwap V3 (opBNB) Fee Calculator

Transaction Details

Key Features Comparison

- Concentrated Liquidity ✓

- Smart Order Routing ✓

- Limit Orders ✓

- TWAP Orders ✓

- Ultra-Low Fees ✓

Fee Analysis

Fee Structure Comparison

| Platform | Trading Fee | Avg Gas Cost |

|---|---|---|

| PancakeSwap V3 (opBNB) | 0.05% - 0.10% | $0.0003 |

| PancakeSwap V2 | 0.25% | $0.001 |

| Uniswap V3 (Ethereum) | 0.05% - 0.30% | $2 - $5 |

Your Savings Analysis

Important Notes

- OpBNB offers up to 90% reduction in gas fees compared to Ethereum

- V3 fees are up to 25x lower than V2

- Currently supports only 3 base tokens (USDT, ETH, CAKE)

- Concentrated liquidity improves capital efficiency

When talking about PancakeSwap V3 (opBNB) is a decentralized exchange (DEX) built on the opBNB layer‑2 network, offering concentrated liquidity and ultra‑low fees, the first question most readers ask is whether it lives up to the hype surrounding modern AMM upgrades. This review breaks down the technical upgrades, real‑world performance numbers, user experience quirks, and where the platform fits among today’s DeFi options.

TL;DR

- Operates on opBNB, a BNB Smart Chain Layer2 that cuts gas by >90%.

- Only 3 tokens (USDT, ETH, CAKE) paired with WBNB, but liquidity is deep thanks to concentrated liquidity.

- Fees are up to 25× lower than PancakeSwap V2 and comparable to centralized exchanges.

- Smart Order Routing, limit orders, and TWAP give traders tools usually found on CEXs.

- Major downside: limited token selection - expansion is the next big milestone.

What is opBNB and why does it matter?

opBNB is a Layer2 scaling solution for the BNB Smart Chain, launched in 2023 to address high gas costs and network congestion on the base chain. By bundling transactions off‑chain and settling them in batches, opBNB delivers sub‑second finality and transaction fees that are a fraction of those on Ethereum or even the main BNB Smart Chain.

Because PancakeSwap V3 (opBNB) runs directly on this network, users experience faster swaps, cheaper approvals, and smoother interaction with advanced order types.

Technical upgrades that set V3 apart

The jump from V2 to V3 isn’t just a UI refresh. Three core innovations drive the new experience:

- Concentrated liquidity: Liquidity providers (LPs) can now allocate capital to a narrow price band instead of the entire curve. This mirrors the model pioneered by Uniswap V3 and boosts capital efficiency by up to 400% according to on‑chain analytics.

- Smart Order Routing (SOR): The router scans multiple pools across the opBNB deployment, automatically routing trades through the pool with the best price and lowest slippage.

- Advanced order types: Limit orders, time‑weighted average price (TWAP) orders, and stop‑loss features bring DEX trading closer to the functionality of centralized exchanges.

These features are wrapped in the familiar PancakeSwap UI, meaning users don’t need to learn a brand‑new interface to benefit from the upgrades.

Supported tokens and real‑world volume

At the time of writing, the opBNB deployment lists three base tokens paired with Wrapped BNB (WBNB):

- USDT - a stablecoin widely used for cross‑chain transfers.

- ETH - the Ethereum native asset, bridged onto opBNB.

- CAKE - PancakeSwap’s own governance token.

All three trade against WBNB. The USDT/WBNB pair dominates ~73% of daily volume, roughly $7,800 on an average day. ETH/WBNB contributes about $2,700, while CAKE/WBNB accounts for the remaining $200. Total 24‑hour volume oscillates between $10,600 and $14,200, indicating healthy activity for a niche deployment.

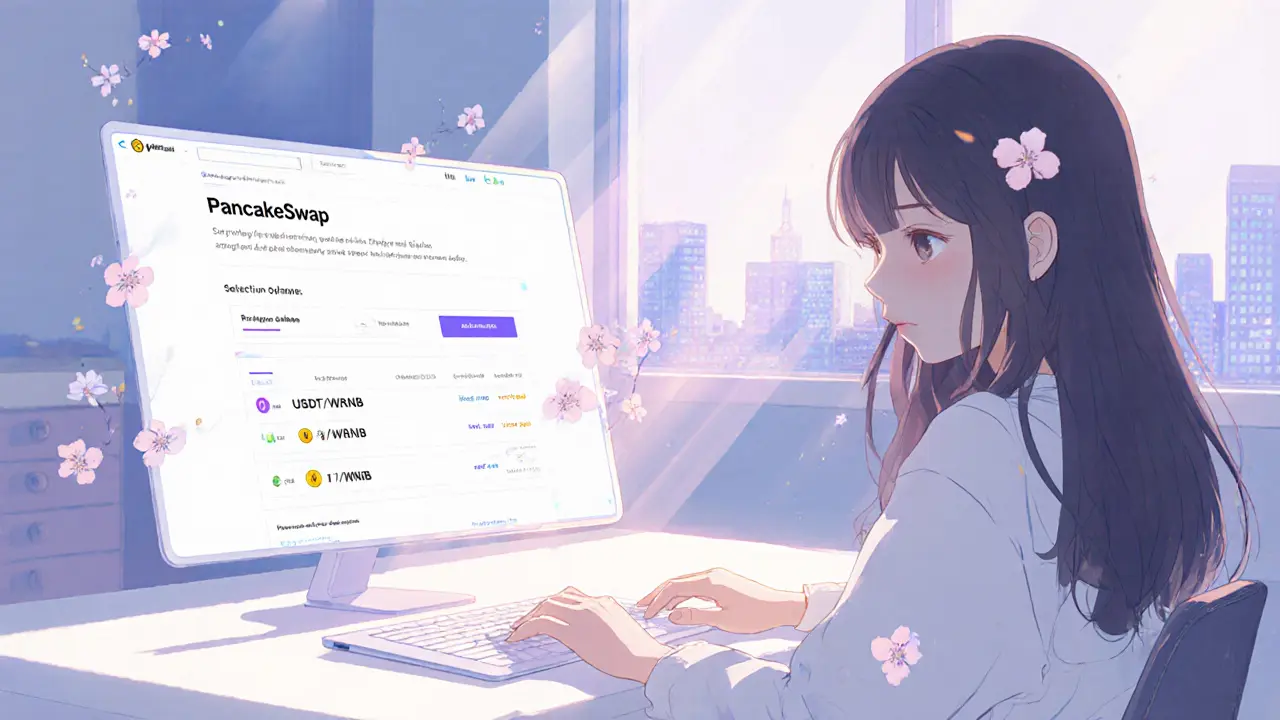

Fee structure and cost comparison

PancakeSwap V3 (opBNB) employs a tiered fee model:

- 0.05% for most stable‑coin pairs (USDT/WBNB).

- 0.10% for more volatile assets (ETH/WBNB).

- Liquidity providers earn a portion of these fees proportional to their position within the selected price range.

Compared to PancakeSwap V2’s flat 0.25% fee, the V3 rates are up to 25× cheaper. On the opBNB network, gas for a typical swap averages $0.0003, whereas an equivalent Ethereum‑based trade on Uniswap V3 can exceed $2 in gas fees during peak periods.

How to get started (step‑by‑step)

- Open a compatible wallet (MetaMask, Trust Wallet, or Binance Chain Wallet).

- Add the opBNB network:

- Network name: opBNB

- RPC URL: https://opbnb‑rpc.com (example)

- Chain ID: 204

- Currency symbol: BNB

- Bridge assets from BNB Smart Chain or another supported chain using the official Binance Bridge.

- Navigate to the PancakeSwap V3 (opBNB) UI, connect your wallet, and select a pool.

- If you’re providing liquidity, define a price range-e.g., $300‑$350 for USDT/WBNB-and deposit the corresponding token amounts.

- Execute swaps, set limit orders, or monitor your LP position via the “Your Liquidity” tab.

The onboarding flow adds a modest learning curve for newbies, but most community tutorials walk users through each step in under ten minutes.

Pros, cons, and user sentiment

| Pros | Cons |

|---|---|

| Ultra‑low fees thanks to opBNB | Only three trading pairs available |

| Concentrated liquidity improves capital efficiency | Advanced LP concepts can be confusing for beginners |

| Smart Order Routing reduces slippage | Limited documentation specific to opBNB deployment |

| Integrated limit & TWAP orders | Reliance on Binance ecosystem may attract regulatory scrutiny |

Community forums consistently praise the fee savings and UI familiarity, while many users request an expanded token list. New LPs often need extra guidance to set price ranges, but once familiar, they report higher yields than on V2.

How does it stack up against other DEXs?

| Feature | PancakeSwap V3 (opBNB) | PancakeSwap V2 | Uniswap V3 (Ethereum) |

|---|---|---|---|

| Network | opBNB (Layer2 BNB) | BNB Smart Chain | Ethereum L1 |

| Trading fee | 0.05‑0.10% | 0.25% | 0.05‑0.30% |

| Gas cost (average swap) | ≈$0.0003 | ≈$0.001 | ≈$2‑$5 |

| Concentrated liquidity | Yes | No | Yes |

| Smart Order Routing | Yes | No | No (external routers needed) |

| Supported pairs | 3 (USDT, ETH, CAKE / WBNB) | ~200+ | ~500+ |

The table makes it clear: PancakeSwap V3 (opBNB) shines on cost and speed but lags on token variety. For traders who only need stablecoins or core assets, the trade‑off is worth it.

Future outlook

Growth hinges on two factors:

- opBNB adoption: As more projects bridge to opBNB, liquidity will deepen and new token listings become viable.

- Feature rollouts: PancakeSwap’s roadmap mentions upcoming cross‑chain swaps, perpetual futures, and NFT marketplace integrations on all Layer2 deployments. If the opBNB version gets these upgrades, it could close the functionality gap with larger DEXs.

Regulatory pressure on Binance‑linked projects remains a wildcard, but the technical merits of the opBNB stack give the platform a solid foundation for 2025 and beyond.

Frequently Asked Questions

Do I need BNB to trade on PancakeSwap V3 (opBNB)?

You need Wrapped BNB (WBNB) as the base currency for all pairs. You can obtain WBNB by bridging regular BNB from the BNB Smart Chain to opBNB or by swapping other tokens once you’re connected.

How risky is providing concentrated liquidity?

Concentrated liquidity can boost returns, but if the market price moves out of your chosen range, your liquidity becomes inactive and you earn only fees when price re‑enters. New LPs should start with a wide range or use the platform’s “auto‑range” helper.

Can I use a hardware wallet with PancakeSwap V3 (opBNB)?

Yes. Ledger and Trezor devices work through MetaMask or WalletConnect. Just make sure the opBNB network is added to the wallet firmware.

Why are there so few tokens listed?

The opBNB deployment is still early‑stage. PancakeSwap’s team prefers to launch a handful of high‑liquidity pairs first, then expand as more projects migrate to opBNB.

Is my capital safe on a DEX?

Since you retain full control of private keys, the exchange cannot seize your funds. However, smart‑contract bugs or malicious tokens can cause losses. Always audit contracts and start with small amounts.

Joel Poncz

February 26, 2025 AT 12:49Yo the fee drop on PancakeSwap V3 is wild, feels like a breath of fresh air for small traders.

Kris Roberts

March 6, 2025 AT 15:16Honestly, the ultra‑low gas on opBNB makes swapping feel instant.

It's like the old days when you could trade without waiting for confirmations.

lalit g

March 14, 2025 AT 17:42Appreciate the concise breakdown of the fee tiers. The 0.05% for stable‑coin pairs really encourages volume.

Reid Priddy

March 22, 2025 AT 20:09Sure, the fees are low, but remember the centralization risk tied to Binance’s ecosystem – hidden forks could surface.

Shamalama Dee

March 30, 2025 AT 23:36From a mentorship perspective, it is essential to underline that while PancakeSwap V3 (opBNB) offers dramatic fee reductions, users must first secure a reliable wallet that supports the opBNB network. Adding the network to MetaMask involves entering the correct RPC, chain ID, and BNB as the native currency. Once configured, bridging assets from BNB Smart Chain to opBNB is straightforward via the official Binance Bridge; however, users should verify the bridge’s contract address to avoid phishing attempts.

When selecting a liquidity pool, the concentrated liquidity model permits LPs to allocate capital within a precise price range, improving capital efficiency up to four‑fold compared to V2. This precision does require a sound understanding of market dynamics; novices may benefit from employing the platform’s auto‑range feature, which suggests optimal bounds based on recent price data.

Trading fees now sit at 0.05% for USDT/WBNB and 0.10% for ETH/WBNB, representing a 25× reduction from the legacy 0.25% V2 fee. Gas costs are minuscule-approximately $0.0003 per swap-ensuring that even micro‑trades remain economical.

Nevertheless, the token repertoire is limited to three base assets paired with WBNB. Expansion of the pair list will be crucial for broader adoption, as many traders seek exposure to emerging alt‑coins.

Finally, users should consistently monitor the Smart Order Routing mechanism; it navigates across multiple pools to secure the best price, thereby reducing slippage. In summary, the platform delivers unprecedented cost efficiency but demands a measured approach to liquidity provision and network configuration.

scott bell

April 8, 2025 AT 02:02Step‑by‑step, the onboarding flow is less scary than it looks.

Just hit the network add, bridge some BNB, and you’re swapping in seconds.

vincent gaytano

April 16, 2025 AT 04:29Oh great, another "ultra‑low fee" DEX that will probably disappear when the next rug pull hits.

Dyeshanae Navarro

April 24, 2025 AT 06:56Simple: low fees, fast swaps, limited pairs. Good for a start.

Matt Potter

May 2, 2025 AT 09:22Let’s keep the momentum! Those fee savings are a real game‑changer for high‑frequency traders.

Marli Ramos

May 10, 2025 AT 11:49meh… looks cool 😒 but why only three pairs??

Christina Lombardi-Somaschini

May 18, 2025 AT 14:16While the fee structure is indeed compelling, it is prudent to consider the security implications of bridging assets onto a relatively nascent Layer‑2 solution. The opBNB network, albeit efficient, has not undergone the same breadth of scrutiny as Ethereum’s mainnet. Consequently, best practices such as initiating modest test transactions, verifying contract addresses, and employing hardware wallets where feasible remain advisable. Moreover, the concentration of liquidity within narrow price bands, while advantageous for capital efficiency, introduces heightened exposure to price volatility should market movements exceed the defined ranges. Users unfamiliar with these dynamics might opt for broader ranges or the platform’s auto‑range utility to mitigate the risk of inactive capital. In sum, the attractiveness of ultra‑low fees should be balanced against thorough risk assessment and prudent operational safeguards.

katie sears

May 26, 2025 AT 16:42Indeed, the aforementioned precautions are essential.

Furthermore, when employing hardware wallets, ensure that the opBNB network parameters are correctly imported into the device’s firmware to avoid transaction rejection.

It is also advisable to monitor the official Binance announcements for any updates on opBNB’s security audits, as these can provide additional assurance for custodial‑free trading activities.

Gaurav Joshi

June 3, 2025 AT 19:09Low fees are great, but we must not ignore the ethical dimension of aligning with a platform that could be subject to regulatory scrutiny.

Kathryn Moore

June 11, 2025 AT 21:36PancakeSwap V3 (opBNB) offers lower fees, higher speed, and better liquidity concentration.

Christine Wray

June 20, 2025 AT 00:02Balanced view: the cost advantage is undeniable, yet the limited token selection may hinder wider adoption.

roshan nair

June 28, 2025 AT 02:29Technical tip: when setting a price range for concentrated liquidity, consider using recent volatility metrics; this helps keep your capital active and earning fees across different market conditions.

Also, remember that the opBNB network’s block time is approximately 1 second, so transaction finality is near‑instant, which is a major benefit over L1 chains.

Jay K

July 6, 2025 AT 04:56In conclusion, the opBNB deployment represents a promising step forward for the BNB ecosystem, provided that community and developer support continue to expand token offerings and enhance documentation.