SolarX (SXCH) Token Calculator

Token Information

Symbol: SXCH

Total Supply: 400 million

Launch Date: May 24, 2024

Initial Price: $0.10

Current Price: $0.001

ROI Since IDO: -92%

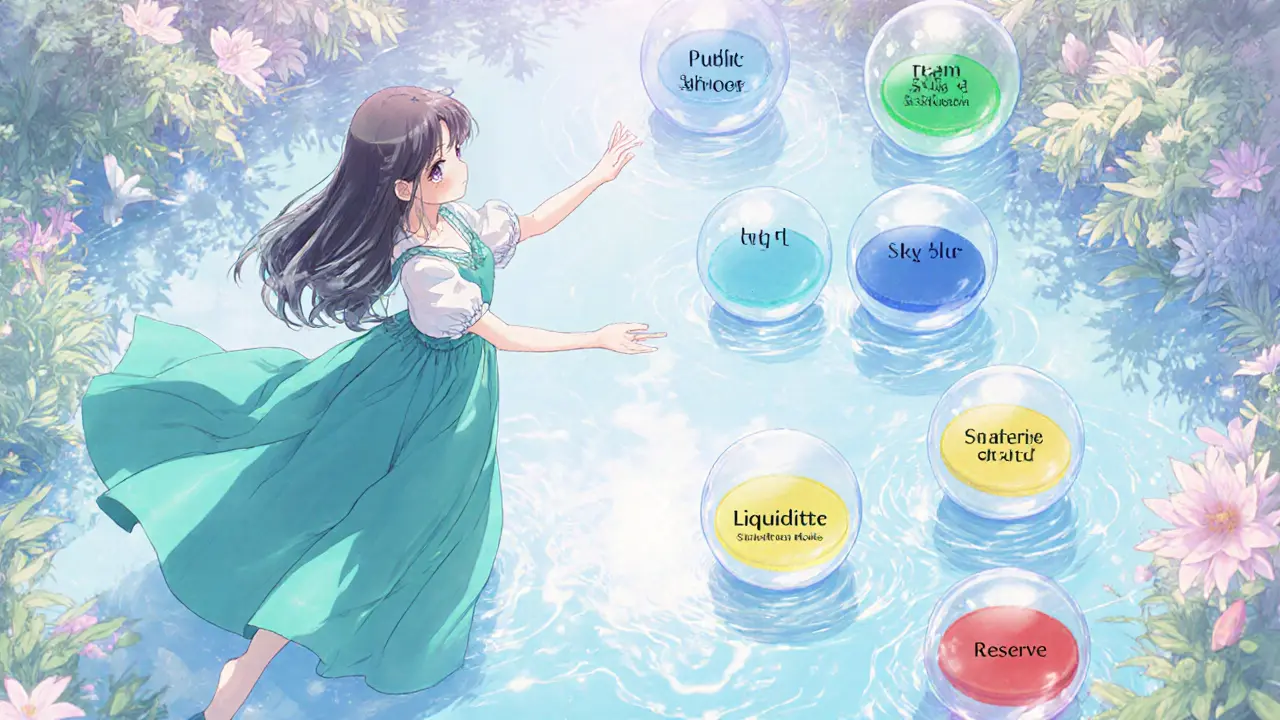

Token Distribution

Investment Calculator

Investment Analysis

Tokens Purchased: 0

Current Value: $0.00

Target Value: $0.00

Potential Return: +0%

Key Metrics

Quick facts

- Launch date: 24May2024

- Token symbol: SXCH

- Total supply: 400million tokens

- Initial price (IDO): 0.1USDT per token

- Current price (Oct2025): ~0.001USDT

What is SolarX?

SolarX is a renewable‑energy‑focused cryptocurrency that runs on its own layer‑1 blockchain. It was launched on 24May2024 to address the massive electricity consumption of traditional proof‑of‑work coins. By powering every node with solar or wind farms, SolarX promises a carbon‑neutral mining process.

Token basics and the IDO

The project’s native token carries the ticker SXCH. An Initial DEX Offering (IDO) took place on 25May2024, raising US$3million at 0.1USDT per token. Only 7.5% (30million) of the 400million total supply were sold to the public, leaving the majority for the development team, strategic partners, and future ecosystem incentives.

Tokenomics at a glance

| Category | Allocation | Tokens |

|---|---|---|

| Public sale (IDO) | 7.5% | 30M |

| Team & advisors | 20% | 80M |

| Staking rewards | 15% | 60M |

| Liquidity & partnerships | 25% | 100M |

| Reserve | 32.5% | 130M |

The relatively low public‑sale portion signals a conservative approach, but it also means early investors hold a smaller slice of the total pie.

Market performance so far

After debuting at $0.10, SXCH plunged to an all‑time low of $0.0027 in July2025. As of 2October2025 the price hovers around $0.001, a 97% drop from its peak. Daily trading volume sits between US$33k and US$54k, with the highest activity on the MEXC exchange, where the SXCH/USDT pair moves roughly US$53k per day.

Technical charts show a neutral trend: the 50‑day moving average has slipped below the 200‑day line, yet price remains above both averages, indicating short‑term indecision. Volatility remains high; 24‑hour price swings range from $0.0031 to $0.0033 on some data feeds, while other feeds list the token near $0.00093. Such discrepancies underline the fragmented nature of SXCH’s market data.

How the layer‑1 blockchain works

SolarX’s layer‑1 blockchain is built from the ground up to run exclusively on renewable sources. Instead of relying on energy‑intensive proof‑of‑work, the network uses a hybrid proof‑of‑stake/ proof‑of‑authority model that rewards validators who can prove their power comes from solar or wind farms. This design reduces electricity usage by an estimated 90% compared with Bitcoin’s legacy mining process.

The architecture also allows the chain to scale without congesting existing networks like Ethereum, offering faster finality (under 5seconds) and lower transaction fees (sub‑$0.001 on average).

Staking and where to trade SXCH

Holders can stake SXCH directly on MEXC. The platform offers a simple “Stake Now” button, and rewards are distributed weekly based on the total staked amount. Exact APY figures are not publicly disclosed, but community reports suggest a range of 5‑12% annually.

Besides MEXC, SXCH appears on a handful of decentralized exchanges (Uniswap‑style routers) but liquidity is thin, contributing to the price volatility observed across data sources.

Risks, challenges, and future outlook

Investors face several headwinds:

- Price risk: A -92% ROI since the IDO, with price predictions ranging from $0.00044 to $0.063 by 2026, reflecting extreme uncertainty.

- Adoption risk: Limited community engagement and low daily volume suggest the network has yet to attract a critical mass of developers or users.

- Regulatory risk: While renewable‑energy projects are gaining favor, crypto‑specific regulations could affect token listings or staking services.

On the upside, the environmental narrative could become a differentiator if regulatory bodies start rewarding low‑carbon blockchain solutions. Continued expansion to more exchanges, transparent staking rewards, and tangible renewable‑energy partnerships would help solidify SolarX’s market position.

SolarX vs. traditional crypto: a quick comparison

| Aspect | SolarX (SXCH) | Bitcoin (BTC) |

|---|---|---|

| Consensus | Hybrid PoS/PoA (renewable‑only) | Proof‑of‑Work |

| Energy source | 100% solar / wind | Mixed (majority non‑renewable) |

| Annual electricity use | ~0.5TWh (estimated) | ~150TWh |

| Transaction finality | ~5seconds | ~10minutes |

| Average fee | <$0.001 | ~$25 (2024 avg) |

The table highlights why SolarX markets itself as a greener alternative. However, the network’s size and liquidity are still far behind Bitcoin’s massive ecosystem.

Frequently Asked Questions

What problem does SolarX try to solve?

It aims to remove the huge carbon footprint of crypto mining by running its entire blockchain on renewable energy, offering a low‑impact alternative to proof‑of‑work coins.

How can I buy SXCH?

The most liquid market is the SXCH/USDT pair on MEXC. You can deposit USDT, place a market or limit order, and receive SXCH in your exchange wallet.

Is staking SXCH safe?

Staking is offered only on MEXC, which holds the majority of SXCH liquidity. While the platform is reputable, staking always carries smart‑contract and custodial risk; only stake what you can afford to lose.

What are the long‑term price prospects?

Analysts disagree sharply. Some forecast $0.04‑$0.06 by 2025‑2026 if renewable‑crypto adoption spikes; others warn the token could dip below $0.0005 if market sentiment stays bearish.

Where can I stake SXCH besides MEXC?

At the moment MEXC is the only exchange offering a built‑in staking pool. Some community‑run validators exist on the SolarX network, but they require running a node and proving renewable‑energy sourcing.

Marketta Hawkins

March 14, 2025 AT 22:31SolarX bragging about being “green” while the core team probably sits in a fancy US office, sipping lattes and cashing out on anyone gullible enough to believe a crypto can be truly carbon‑neutral. The whole thing feels like a marketing ploy to ride the eco‑trend, not a real solution. 🌱🚫

Drizzy Drake

March 15, 2025 AT 15:11I get why people are drawn to the idea of a blockchain powered by solar – the concept sounds almost utopian. But looking at the numbers, a 97% drop from the IDO price is a brutal reality check. If the network truly runs on renewable energy, the operating costs should be lower, yet the token’s market cap keeps shrinking. It might be that the ecosystem hasn't attracted enough developers or real‑world use cases yet. Still, there’s a community of validators who believe in the vision, and they’re staking and keeping the chain alive. Maybe patience and more partnerships could turn the tide.

AJAY KUMAR

March 16, 2025 AT 07:51Listen up, this so‑called “SolarX” is just another excuse for a bunch of tech bros to pretend they’re saving the planet while draining wallets. They claim it runs on solar, yet the majority of the hardware is sourced from factories that pour out CO₂ like nobody’s watching. It’s a betrayal of the very environment they claim to protect, and it hurts honest American innovators trying to make a real difference.

bob newman

March 17, 2025 AT 00:31Oh sure, SolarX “reduces electricity usage by 90%” – just like every other crypto that suddenly discovers a magic wand. The only thing that’s truly reduced is the amount of money you’ll ever see again. If you ask me, this is the classic “greenwashing” playbook, painted over with fancy charts and buzzwords to distract you from the fact that it’s still a speculative token. 🎭

Anil Paudyal

March 17, 2025 AT 17:11i saw the token info and it looks like a lot of hype but not much real use yet. kinda sad but maybe they’ll get more traction later.

Kimberly Gilliam

March 18, 2025 AT 09:51Wow, the drama never stops. SolarX promises the moon and delivers dust. Nothing new here.

Jeannie Conforti

March 19, 2025 AT 02:31i think the green angle is cool but the price drop is real. maybe more adoption will help.

tim nelson

March 19, 2025 AT 19:11look, i get the frustration, but tearing it down won’t build anything. if the devs actually push solar farms, that could change the game. give them a chance.

Zack Mast

March 20, 2025 AT 11:51One could argue that the value of SolarX lies not merely in its market price but in the symbolic gesture toward decarbonizing digital finance. Yet symbolism without substance risks becoming an aesthetic veneer, empty as a parchment with no ink. The true test will be whether verifiable megawatts power the validators consistently, or if the claim remains a philosophical footnote. In any case, the conversation pushes us to reconsider energy ethics in blockchain.

Dale Breithaupt

March 21, 2025 AT 04:31SolarX has potential if they secure more exchange listings and clear staking rewards.

Rasean Bryant

March 21, 2025 AT 21:11The token’s ROI is clearly negative.

Angie Food

March 22, 2025 AT 13:51Yeah, “potential” is just a fancy word for “maybe someday”. Don't get your hopes up.

Jonathan Tsilimos

March 23, 2025 AT 06:31From an analytical standpoint, the tokenomics of SolarX present a heterogeneous distribution of capital that may influence market liquidity dynamics. The allocation of 32.5% to a reserve pool introduces a latent supply variable that could be activated under governance decisions, thereby affecting price elasticity. Moreover, the modest public sale proportion of 7.5% constrains the breadth of initial investor dispersion, potentially leading to heightened concentration risk among early stakeholders. The hybrid proof‑of‑stake / proof‑of‑authority consensus mechanism, while innovative, necessitates rigorous validation of renewable energy provenance to substantiate its carbon‑neutral claim. In the absence of transparent audit trails for solar generation, the environmental integrity of the network remains speculative. Historical price performance, characterized by a 97% decline from the IDO peak, reflects a market correction that may be attributed to limited utility adoption and fragmented exchange liquidity. Transaction finality metrics, approximating five seconds, surpass many legacy Proof‑of‑Work networks, yet latency alone does not guarantee network robustness. The average transaction fee, hovering near $0.0005, is competitively low, thereby facilitating micro‑transactions, which could be a catalyst for decentralized application development. However, developer onboarding remains suboptimal, as evidenced by the paucity of publicly released SDKs and integration guides. The staking reward envelope, estimated between 5% and 12% APY, is insufficiently disclosed, raising concerns about yield predictability for long‑term participants. Regulatory considerations, particularly within jurisdictions imposing stringent environmental compliance, may impose additional operational overheads on the protocol. Should SolarX secure strategic partnerships with established renewable energy providers, the resultant synergies could ameliorate credibility deficits. Conversely, the reliance on a limited set of liquidity providers exposes the token to order‑book volatility and slippage. Market sentiment analyses indicate a bifurcated perception: eco‑conscious investors view the project favorably, whereas traditional crypto speculators remain skeptical. In summary, the confluence of token distribution, consensus architecture, and market reception engenders a complex risk‑reward profile that warrants meticulous due diligence prior to capital allocation.

jeffrey najar

March 23, 2025 AT 23:11Great breakdown! To add, the team’s roadmap includes a planned audit of solar source verification by Q2 2026, which should address the provenance concerns you mentioned.

Rochelle Gamauf

March 24, 2025 AT 15:51The discourse surrounding SolarX suffers from a lack of critical rigor; enthusiasts romanticize sustainability without demanding empirical evidence, thereby undermining scholarly evaluation of blockchain energy consumption.

Jerry Cassandro

March 25, 2025 AT 08:31True, the project could benefit from publishing real‑time solar generation metrics to satisfy both investors and academic scrutiny.

Parker DeWitt

March 26, 2025 AT 01:11Everyone’s hyping SolarX like it’s the next big thing 🌞🚀 but the numbers tell a different story-maybe it’s just a meme waiting to explode? 🤔

Allie Smith

March 26, 2025 AT 17:51maybe it’s just waiting for the right community vibe to turn it around – good vibes can change markets lol

Lexie Ludens

March 27, 2025 AT 10:31Oh, the tragedy of SolarX! Once a beacon of hope, now a ghost haunting the crypto graveyard, its once‑bright promise now dimmed to a flicker of forgotten ambition.

Aaron Casey

March 28, 2025 AT 03:11Your poetic lament captures the sentiment, yet from a technical perspective, the chain’s validator set still maintains sub‑second consensus, which could be leveraged for niche DeFi applications if community engagement improves.

Leah Whitney

March 28, 2025 AT 19:51Let’s keep an eye on upcoming partnership announcements; they might be the catalyst that revives interest and brings new staking participants.

Lisa Stark

March 29, 2025 AT 12:31Indeed, the future of any technology hinges not just on its architecture but also on the collective belief of its adopters.

Logan Cates

March 30, 2025 AT 06:11Honestly think the whole thing’s a pump‑and‑dump staged by the devs to cash out before the solar farms even get built.

Shelley Arenson

March 30, 2025 AT 22:51🤨 well, only time will tell, but I'd rather stay skeptical than get burned.