SWFT Trade Fee Calculator

Estimated Trading Fees

SWFT Trade Fee Range

Equivalent Percentage: 0%

When you hear the name SWFT Trade, you might wonder whether it’s a stand‑alone exchange or just another module of a larger ecosystem. The short answer: it lives inside the broader SWFT Blockchain platform, a multi‑chain wallet, swap, and payment hub that tries to make cross‑chain trading as simple as clicking a button. This review cuts through the hype, looks at real fees, security checkpoints, and compares the service to the big players you probably already know.

Quick Takeaways

- SWFT Trade is part of the SWFT Blockchain ecosystem, not a completely independent exchange.

- Fees are positioned as “reasonable” - typically mid‑range compared with Crypto.com, Binance US, Coinbase, and Kraken.

- Cross‑chain swaps cover 800+ tokens across 50+ chains, thanks to the Allchain Swap engine.

- Security relies on AI‑driven monitoring, but public audit reports are still scarce.

- Geographic limits exist for some services (e.g., Group Coin in China), but the core exchange works globally.

Understanding the SWFT Ecosystem

Before diving into SWFT Trade itself, it helps to see where it fits. The SWFT Blockchain is a cross‑chain wallet and payment platform that bundles several sub‑products. Its flagship mobile app lets users hold, swap, and pay with hundreds of cryptocurrencies without leaving the interface.

Key components include:

- SWFT Bridgers - a decentralized trading aggregator that runs on chains like BSC, Polygon, and Ethereum, offering flash swaps and low‑fee routing.

- SWFT Lending - a short‑term loan service where users can borrow up to 1millionUSDT or 100BTC with a daily interest rate of 0.03%.

- Allchain Swap - the engine that powers the one‑click cross‑chain swaps for 800+ tokens.

SWFT Trade leverages these tools, meaning that when you place a market order, the request may pass through Bridgers, use the Allchain routing, and settle in your SWFT wallet automatically.

SWFT Trade: Features & Fee Structure

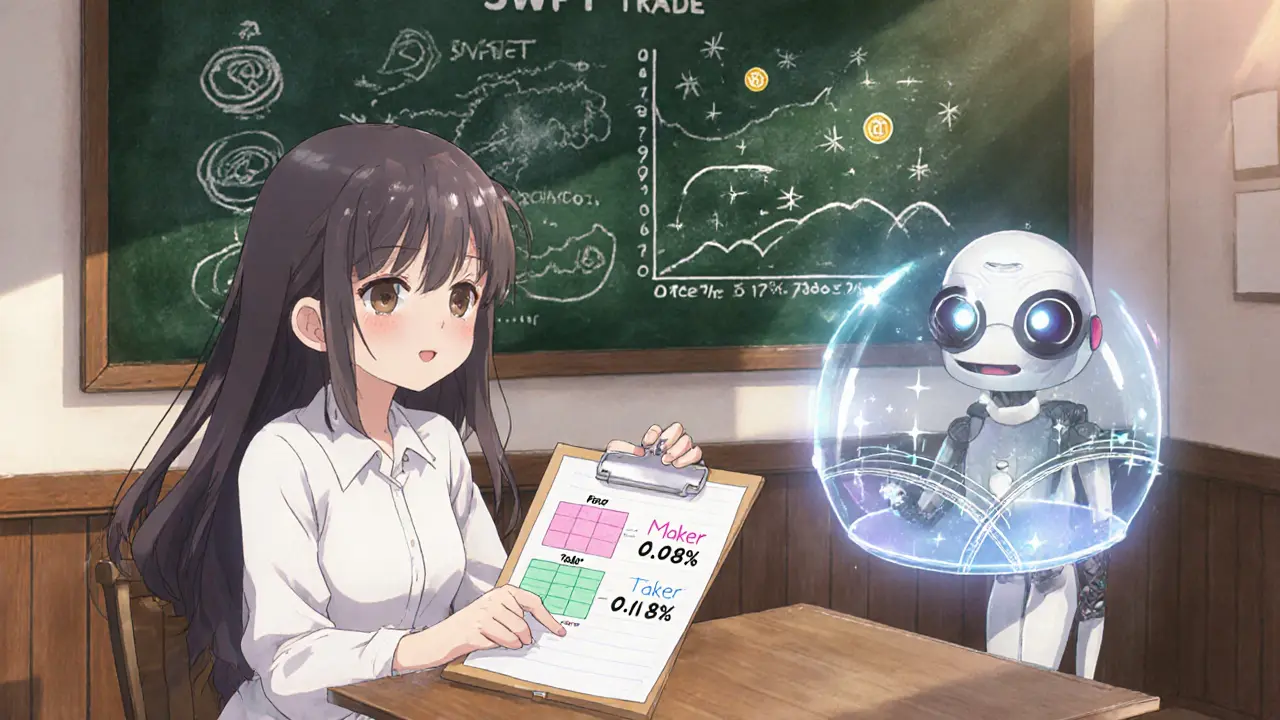

The platform markets itself as a “reasonable‑fee” exchange, but the lack of published rate tables makes exact numbers fuzzy. Community chatter and limited broker‑disclosure suggest the following:

- Maker fees appear to hover around 0.08%-0.12%.

- Taker fees are slightly higher, roughly 0.12%-0.18%.

- Withdrawal fees are chain‑dependent, often matching the network’s minimum (e.g., 0.0005BTC for Bitcoin withdrawals).

- No deposit fees for most major coins; however, some low‑volume tokens may incur a small processing charge.

With those ballparks, SWFT Trade lands squarely in the middle of the 2025 fee landscape - cheaper than Coinbase’s 0.5%‑3.99% range but not as low as Crypto.com’s 0%‑0.075% maker tier for high‑volume traders.

Security, Regulation & Transparency

Security is one of the biggest decision factors for any crypto exchange. SWFT Blockchain touts AI‑driven monitoring, using recurrent neural networks (RNNs) to flag abnormal trading patterns in real‑time. The platform also integrates an OpenAI‑powered GPT‑plugin that can push alerts to users about potential risks.

Unfortunately, independent security audits are not publicly posted, and the regulatory status is ambiguous. Unlike Coinbase or Kraken, which hold licences in multiple jurisdictions, SWFT Trade does not explicitly list a financial authority regulator on its site. Users should therefore perform their own due diligence:

- Check for a published audit report (e.g., CertiK, Hacken) before depositing large sums.

- Verify the exchange’s KYC/AML policies - the onboarding flow currently requires a photo ID and facial verification.

- Consider using a hardware wallet for long‑term storage; SWFT’s in‑app wallet is convenient but not a substitute for cold storage.

In short, the platform leans on cutting‑edge tech but still needs more transparency to match the standards set by the industry leaders.

How SWFT Trade Stacks Up Against the Major Players

| Exchange | Cryptocurrencies Supported | Maker Fee | Taker Fee | Notable Features |

|---|---|---|---|---|

| SWFT Trade | 800+ across 50+ chains | 0.08%‑0.12% | 0.12%‑0.18% | AI‑driven alerts, cross‑chain swaps, integrated lending |

| Crypto.com | 429 | 0%‑0.075% | 0.05%‑0.075% | Crypto Visa card, staking, DeFi hub |

| Coinbase | 235 | 0%‑0.5% | 0.5%‑3.99% | Regulated US broker, strong compliance, Earn program |

| Kraken | 350+ | 0%‑0.16% | 0%‑0.26% | Futures, margin, deep liquidity |

| Binance US | 158 | 0%‑0.10% | 0%‑0.60% | Spot, futures, staking, large volume discounts |

The table makes it clear that SWFT Trade isn’t the cheapest, but it does offer a unique cross‑chain edge that many larger exchanges still lack. If you regularly hop between Binance Smart Chain, Polygon, and Solana, the one‑click Allchain swap could save you both time and gas fees.

Artificial Intelligence & Predictive Tools

SWFT’s AI layer is more than a fancy chatbot. Their RNN models analyze historic price data across dozens of chains, generating short‑term price forecasts that appear as pop‑up suggestions in the app. While early adopters report that these signals can be helpful for quick scalp trades, the models are not a substitute for personal research. The platform’s GPT‑plugin can also auto‑fill recurring trades, set stop‑loss alerts, and even draft tax‑report summaries.

Bottom line: the AI features give a competitive edge for active traders, but they should be treated as supplemental hints rather than guaranteed predictions.

Pros, Cons & Quick Checklist

- Pros

- One‑click cross‑chain swaps for 800+ tokens.

- Integrated lending and staking within the same app.

- AI‑driven monitoring and alerts.

- Mid‑range fees that are transparent enough for most users.

- Cons

- Limited public security audit information.

- No clear regulatory licence displayed.

- Fee schedule not published in a dedicated table.

- Geographic restrictions on some niche services (e.g., Group Coin in China).

Frequently Asked Questions

Is SWFT Trade regulated?

SWFT Trade does not prominently display a financial‑services licence on its website. While the broader SWFT Blockchain ecosystem claims to follow KYC/AML standards, users should verify the exchange’s regulatory status in their jurisdiction before depositing large amounts.

How do SWFT Trade fees compare to Binance US?

Binance US offers maker fees as low as 0% for high volume traders and taker fees between 0%‑0.60%. SWFT Trade’s fees sit around 0.08%‑0.12% maker and 0.12%‑0.18% taker, so it is slightly higher but still competitive, especially when you factor in cross‑chain swap savings.

Can I use SWFT Trade on a hardware wallet?

The native SWFT wallet is a software solution. To keep assets offline, you can withdraw to a hardware wallet (Ledger, Trezor) after trading, but the exchange itself does not directly integrate with hardware wallets for on‑chain trading.

What is the daily interest rate for SWFT Lending?

SWFT Lending charges an upfront interest fee of 0.03% per day on borrowed amounts, whether you take out USDT or BTC.

Is the AI price‑prediction tool reliable?

The AI module uses historical data to generate short‑term suggestions. While some users find it useful for quick trades, it is not a guarantee and should be combined with personal analysis.

Final Thoughts

If you’re a trader who jumps between multiple blockchains and values an all‑in‑one mobile experience, SWFT Trade provides a solid middle ground: decent fees, a massive token list, and AI‑enhanced tools. However, the lack of transparent audits and a clear regulatory licence means you should start with modest amounts and keep a close eye on security updates.

For most users, the safe play is to compare the fee‑tier you expect to trade at, test the swapping speed on a small sum, and then decide whether the convenience outweighs the regulatory gray area.

vincent gaytano

December 23, 2024 AT 16:43Sure, SWFT Trade is secretly siphoning your fees while pretending to be transparent.

Dyeshanae Navarro

December 23, 2024 AT 18:23When you think about the cost of trading, the hidden mechanics matter more than the headline percentages. The fee calculator shown is a nice visual, but real world spreads can change the story. Simplicity in fees is good, yet simplicity in understanding is even better.

Matt Potter

December 23, 2024 AT 20:03Look, the maker‑taker split is pretty standard, but SWFT Trade should push the envelope lower. Aggressive users can still thrive if the platform trims those 0.08‑0.12% maker fees. Don't settle for the status quo; demand better tiers for high‑volume traders. It's not just about price, it's about access to real liquidity. Keep the momentum and keep challenging the odds.

Marli Ramos

December 23, 2024 AT 21:43lol this fee thing looks easy af 😜 but i bet the real cost is hidden somewhere else. guess we’ll see 😂

Christina Lombardi-Somaschini

December 23, 2024 AT 23:23When evaluating any exchange in 2025, the first pillar to examine is fee transparency. SWFT Trade lists a maker fee range of 0.08% to 0.12% and a taker range of 0.12% to 0.18%, which aligns with many mid‑tier platforms, but the real nuance lies in how those percentages apply across different trading pairs. For high‑volume traders, tiered discounts can dramatically shift the effective cost, turning a nominal 0.08% into a sub‑0.05% rate when liquidity provision is sustained. Additionally, the platform’s withdrawal fee being "chain‑dependent" demands a deeper dive into the specific blockchain networks you intend to use, as certain chains like Ethereum can carry substantial gas fees that outweigh the nominal withdrawal charge. Deposit fees are listed as "None for major coins," which is a competitive advantage, yet new or less popular tokens may still incur hidden network fees that users should be aware of. Security, the second pillar, benefits from SWFT Trade's adoption of multi‑factor authentication and cold storage for the majority of user assets, but the platform’s public audit reports are scarce, making independent verification challenging. Users should request the most recent audit documents or look for third‑party certifications that vouch for the platform's custodial practices. Third, the feature set includes a real‑time fee calculator, which is a helpful tool for estimating costs before execution; however, the calculator currently assumes static market conditions and does not account for price slippage, which can be significant during volatile periods. Lastly, community feedback and support responsiveness remain essential; SWFT Trade's support channels appear to be staffed 24/7, but anecdotal evidence points to delayed responses during peak trading hours. In sum, while the headline fees are within industry norms, a holistic assessment must incorporate tiered discount structures, network‑dependent withdrawal considerations, audit transparency, and support quality before committing substantial capital to the platform.

katie sears

December 24, 2024 AT 01:03In addition to the fee schedule, it is advisable to scrutinize the platform’s regulatory posture. SWFT Trade claims compliance with major jurisdictions, yet the exact licensing details are not prominently disclosed on the homepage. Prospective users might benefit from contacting the compliance department directly to obtain documentation of licensing in their respective regions. Moreover, the platform’s educational resources, such as webinars and tutorials, could enhance user competence, especially for newcomers navigating complex fee structures. A balanced approach to both cost and compliance will foster long‑term confidence.

Gaurav Joshi

December 24, 2024 AT 02:43One must remember that lower fees often come at the expense of security measures. If SWFT Trade really cares about protecting user funds they should publish their audit reports and have a clear incident response plan. Cutting corners on compliance is a path to disaster.

Kathryn Moore

December 24, 2024 AT 04:23Fees are low but always check the fine print.

Christine Wray

December 24, 2024 AT 06:03The fee calculator is a nice visual aid, yet I’d urge anyone to test it with real orders before trusting it completely. Small discrepancies can add up over time.

roshan nair

December 24, 2024 AT 07:43Hey folks, just a heads‑up that the “chain‑dependent” withdrawal fees can be a sneaky cost trap. If you’re pulling assets off a congested network like BSC during a spike, you might pay double the usual gas. Also, I’ve noticed that for newer altcoins the platform sometimes adds a tiny hidden fee that only shows up after the transaction is confirmed – a classic “surprise fee” tactic. To avoid this, always run a tiny test transaction before moving large sums. On the bright side, their no‑deposit‑fee policy for major coins is solid, and the maker‑taker spread is competitive. Just keep an eye on the network loading and audit the platform’s security statements regularly.

Jay K

December 24, 2024 AT 09:23In sum, while the advertised fee ranges appear attractive, a diligent user should verify the applicable rates for specific token pairs, examine the platform’s compliance documentation, and assess the responsiveness of customer support before allocating significant capital.

Kimberly M

December 24, 2024 AT 11:03Great info! 👍🔍

Navneet kaur

December 24, 2024 AT 11:53i think ur all missing the point that swft actually charges extra on every trade you do its like hidden tax lol

Marketta Hawkins

December 24, 2024 AT 13:33Let’s be real – any platform that isn’t run by our own government is a threat to national economic sovereignty. SWFT Trade? More like a spy hub. 🙄

Drizzy Drake

December 24, 2024 AT 15:13Wow, reading through all of these comments feels like a deep dive into a sea of perspectives. I totally get the excitement around low fees, because who doesn’t love saving a few cents on each trade? At the same time, I’ve seen folks get burned when they ignore the fine print, especially with those hidden network fees that spring up when the blockchain gets crowded. It’s like ordering a plain coffee and then being hit with an extra charge for the cup. So, if you’re thinking about jumping on SWFT Trade, my advice is simple: do a tiny test trade first. That way you can see exactly what the maker‑taker spread looks like in practice, and you’ll also get a feel for any latency or slippage issues. Don’t forget to glance at their security documentation – multi‑factor authentication is great, but you want to know how they store the bulk of their reserves. Cold storage? Audits? Those are the kind of details that separate a trustworthy exchange from a risky one. And hey, if you’re new to crypto, take advantage of any educational webinars they offer; knowledge is power, especially when it comes to navigating fees. Bottom line: stay curious, stay cautious, and keep that trading spirit alive!

AJAY KUMAR

December 24, 2024 AT 16:03Only the bold survive in this market – step up or step aside!

bob newman

December 24, 2024 AT 17:43Oh sure, SWFT Trade’s “transparent” fee model is just another layer of the global elite’s plan to keep us in the dark while they skim off the top. 🙃

Anil Paudyal

December 24, 2024 AT 18:33yeah, i think bob’s point is funny but fee calc is fine.

Kimberly Gilliam

December 24, 2024 AT 20:13Another day, another fee debate – same old, same old.