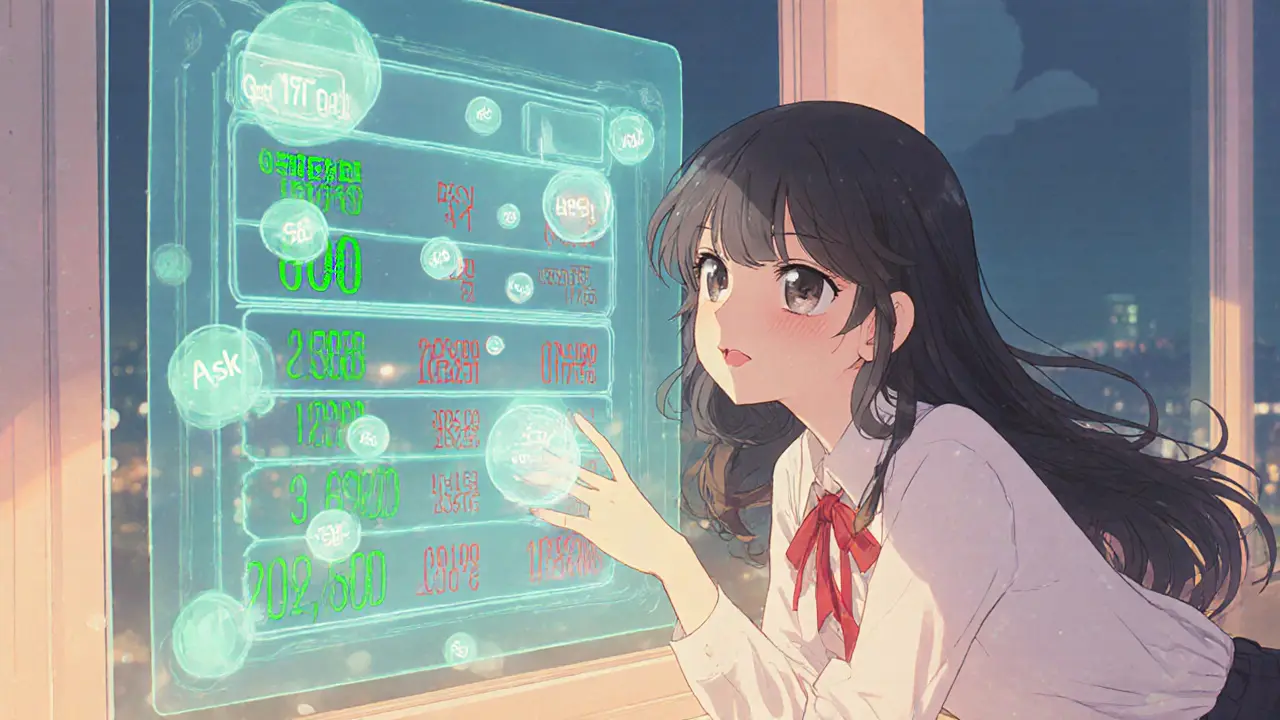

Order Book

When working with Order Book, a real‑time list that shows every buy and sell order for a trading pair on an exchange. Also known as order ledger, it captures market intent at any moment and lets traders see who wants to buy, who wants to sell, and at what prices.

The health of an order book hinges on Liquidity, the ease with which an asset can be bought or sold without moving the price much. High liquidity fills gaps in the book, creating a smoother Market Depth, the range of price levels where substantial order volume sits. When liquidity is thin, even a small trade can shift prices, making depth shallow and price impact large. This relationship means that order books with deep market depth usually enjoy tighter spreads and more reliable price signals.

Why Order Books Matter

Every exchange relies on the order book to match traders. The Bid‑Ask Spread, the difference between the highest buying price (bid) and the lowest selling price (ask) is directly read from the top of the book. A narrow spread signals healthy competition, while a wide spread often hints at low liquidity or high volatility. Traders watch these metrics to gauge entry timing, set stop‑loss levels, or decide whether to place market or limit orders. Understanding how the spread interacts with depth helps you avoid slippage and improves execution quality.

Modern platforms provide visual depth charts, heat maps, and real‑time feed APIs that turn raw order data into actionable insights. By decoding the layers of bids and asks, you can spot hidden walls, iceberg orders, and potential breakouts before they fully materialize. These tools let both novices and pros extract signal from noise, turning the order book from a static list into a dynamic trading advantage.

Below you’ll find a curated set of articles that break down each of these concepts in detail—from basic definitions to advanced strategies for reading depth. Whether you’re fine‑tuning a scalping routine or just getting a feel for market mechanics, the guides ahead will give you the context you need to use the order book effectively.

Market Orders vs Limit Orders in Order Books: How to Trade Crypto Without Getting Slipped

Learn how market and limit orders work in crypto order books, when to use each, and how to avoid costly slippage. Essential for anyone trading Bitcoin, Ethereum, or altcoins on exchanges.

Market Makers & Order Books: Inside Liquidity Strategies

Learn how market makers use order books to provide liquidity, manage risk, and profit from spreads in both centralized and decentralized exchanges.