Crypto Exchange Security: How to Stay Safe on Trading Platforms

When you trade crypto, your money lives on a crypto exchange, a digital platform where you buy, sell, or swap cryptocurrencies. This is where the real risk lies—not in the coins themselves, but in who’s holding them for you. Unlike banks, most exchanges don’t insure your holdings. If they get hacked, you could lose everything. That’s why crypto exchange security, the set of practices and technologies used to protect user funds and data on trading platforms isn’t optional—it’s your first line of defense.

Top exchanges use cold storage, offline wallets that keep the majority of user funds away from internet-connected systems to reduce hacking risk. But not all do. Some keep most coins online for faster withdrawals, which makes them sitting ducks. Then there’s KYC, the process of verifying your identity before allowing trading. It sounds like a nuisance, but it’s how regulators stop money laundering and how exchanges can freeze accounts tied to fraud. And don’t ignore two-factor authentication, a second step—like a code from your phone—that blocks unauthorized logins. If you’re still using just a password, you’re already behind.

Look at what happened to TradeOgre. Canada seized over $56 million because the exchange didn’t follow basic KYC rules. That’s not a glitch—it’s a pattern. Platforms that skip compliance often skip security too. Meanwhile, exchanges like FlatQube and Bitozz show how structure matters: one built for DeFi with non-custodial controls, the other fading into obscurity after failing to update its security model. The difference? One understood that security isn’t a feature—it’s the foundation.

You don’t need to be a tech expert to stay safe. Start by checking if the exchange you use stores most coins offline. Turn on two-factor authentication—no exceptions. Avoid exchanges that don’t require ID verification. And never keep large amounts on any exchange longer than you have to. The posts below dive into real cases: how a shutdown happened, why some platforms vanish, what regulators are doing, and how to spot the ones worth trusting. This isn’t theory. It’s what keeps your crypto safe in the real world.

YEX Crypto Exchange Review: Red Flags and Why You Should Avoid It

YEX crypto exchange shows no signs of legitimacy - no security features, no audits, no user reviews. This isn't a new platform - it's a scam. Learn why you should avoid it and how to spot fake exchanges before it's too late.

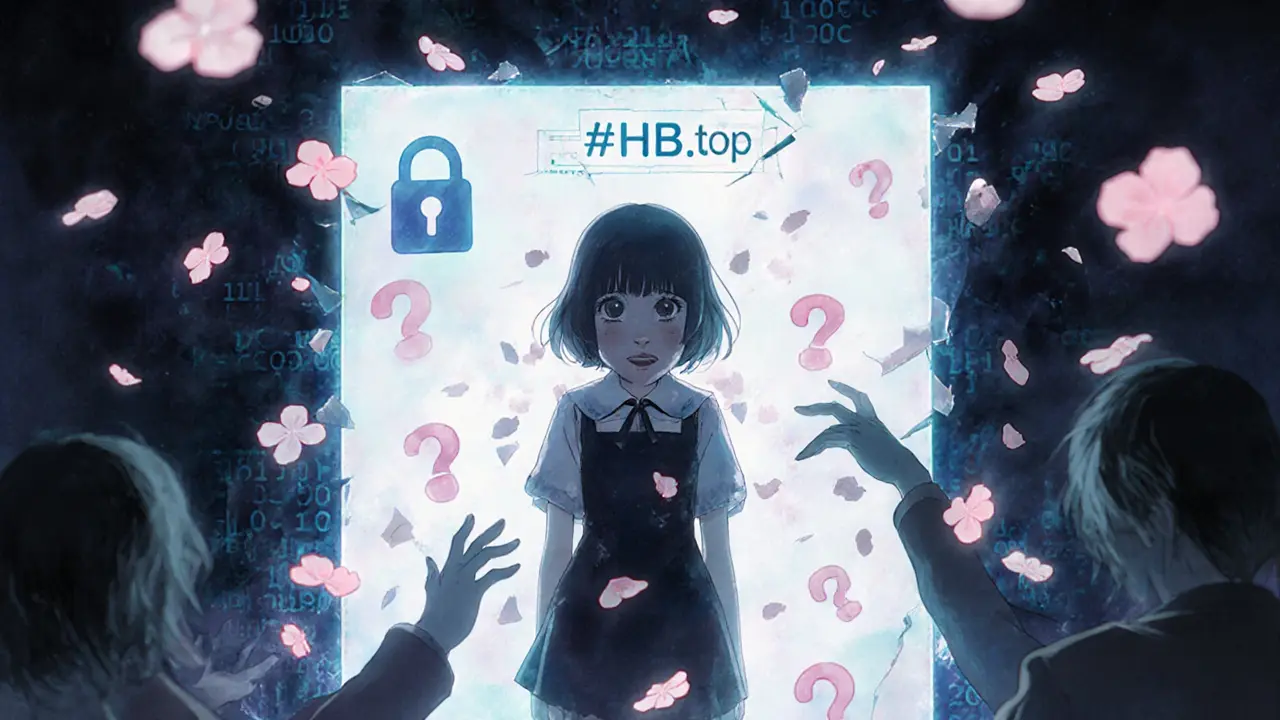

HB.top Crypto Exchange Review: Is It Safe to Trade on HB.top in 2025?

HB.top crypto exchange shows no public security details, regulatory status, or user reviews as of 2025. Without audits, cold storage info, or insurance, it's too risky to use. Stick to verified platforms like Kraken or Coinbase instead.